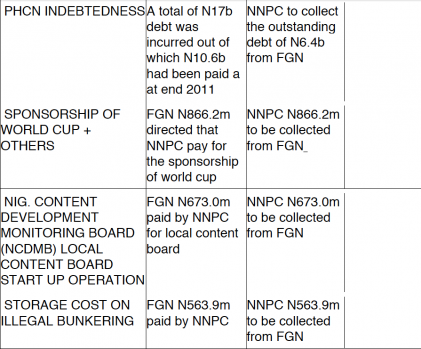

In its 178-page report, obtained by PREMIUM TIMES last night, the committee revealed how oil money in the custody of the NNPC were spent on extra-budgetary purposes such as the acquisition of a N2.23billion chopper for the president and a purported sponsorship of the World Cup.

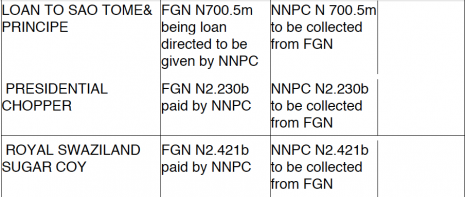

In what appears a brazen misuse of public funds, the NNPC also gave out N700.5million in loan to Sao Tome & Principe based on instruction from the presidency. It also made a curious payment of N2.421billion to a foreign company, Royal Swaziland Sugar Company. The reason for the payment is unclear.

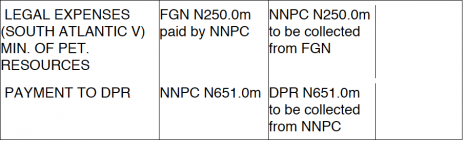

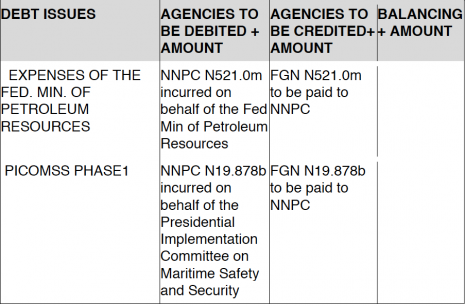

The Corporation also claimed to have underwritten a N521million expenses incurred by the Federal Ministry of Petroleum Resources. This is in addition to the N250million the agency told the committee it spent on court cases involving the ministry.

The ministry has its own budgetary allocation and it is unclear why the NNPC is paying for its expenses. The nature of some of the expenses are also unclear.

The committee also found that the NNPC was being used as illegal lender to presidential committees, ministries and parastatals. For instance the corporation claimed it incurred about N20billion on the Presidential Implementation Committee on Maritime Safety and Security, based on instruction from the presidency.

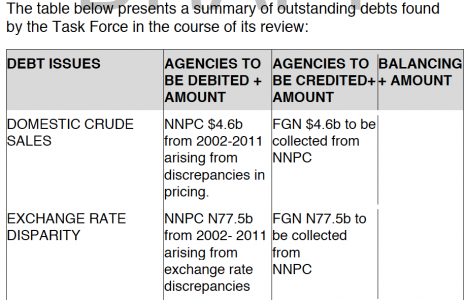

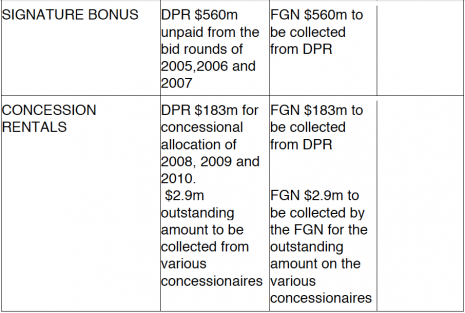

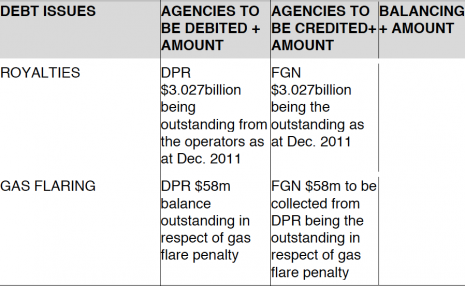

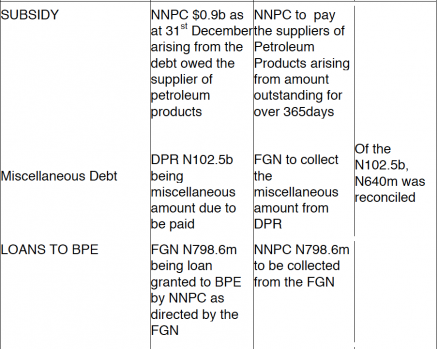

The Ribadu committee also determined that about $1billion in signature bonuses, discrepancies in payment by the NNPC, and debts from oil companies were unaccounted for by the NNPC and the Department of Petroleum Resources.

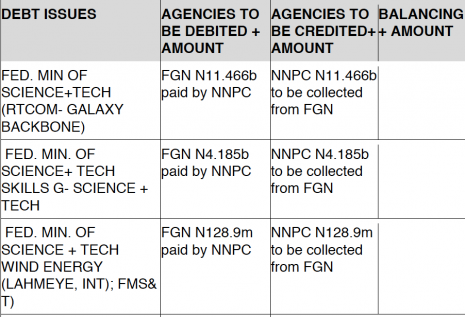

Find table of missing money as documented by the Ribadu committee below.

Download full report of the committee below.

www.premiumtimesng.com/docs_download/Report_of_the_Ribadu_led_Petroleum Revenue Special Task Force 2012.pdf

Excerpts of the report

“…Theft of crude oil and refined petroleum products may be reaching emergency levels in Nigeria. The Task Force has received reports suggesting that volumes stolen have risen dramatically in the past 12-18 months. The Royal Dutch Shell Company, Shell in its presentation to the Task Force stated that an estimated 150,000 barrels of crude oil are stolen per day (about 6% of Nigeria’s total annual production) causing a revenue loss of $13.5 million per day (at $100 per barrel) which amounts to $5billion per year of lost revenue.

On the other hand, high ranking Officials and Executives in the Federal Government tasked with the management of the nation’s strategic Oil and Gas assets have several times stated the existence of large-scale on-going theft of Nigeria’s crude oil. This represents government acknowledgment of the magnitude of the loss. Mr. Leke Oyewole, a Senior Special Adviser to President Goodluck Jonathan on Maritime Affairs, disclosed to the media in March, 2012 that Nigeria loses about 40 million metric tonnes of petroleum products amounting to about $20 billion (N3 trillion) to crude oil theft and illegal bunkering; while NNPC has publicly stated that it spent $1.2billion in the last ten years on pipeline repairs.

Further to the above, the Honourable Minister of Petroleum Resources had also stated at a media briefing in May, 2012 that the country was losing about $7billion annually to crude oil theft in Nigeria, at the rate of 180,000 barrels per day. Indeed, President Goodluck Jonathan has acknowledged the scale and seriousness of crude oil theft in Nigeria as being incomparable to anywhere else in the world, describing the occurrence as being cancerous to the nation’s economy.

The Ministry of Finance has taken a middle ground, stating theft claimed 17 percent of daily production nationwide in April. Overall, estimates of crude oil stolen or spilled reviewed by the Task Force ranged from 6 to 30 percent of production, with 35 percent claimed for one especially troubled area. Based on these estimates, the Task Force believes Nigeria could be losing over N1tn per year to crude oil theft.

The Task Force does not endorse any of the numbers it received as solely authoritative. The bases for many were unclear, and the decentralized, secretive nature of oil theft makes it difficult for any one party to know the full extent of losses. There is a lack of consensus on the actual loss, naturally public records are not satisfactory in this regard but it could actually be as high as 250,000 barrels per day closer to 10% of daily productions.

However, submissions to the Task Force on oil theft suggest that the problem needs immediate attention.

NNPC and oil company data shows dramatic recent rises in theft and sabotage. For example, Shell claims it found at least 50 tap points on its 90km Nembe trunk line in January 2011 alone. Shell submissions to the Task Force showed average total losses in its operational areas climbing from 10,000bpd in late 2009 to over 50,000bpd in March 2012. Chevron reports 29 tap points for the year so far, and claims volumes lost from its operations in Q1 2012 exceeded losses for all of 2011. The NNPC put its total losses from 2009 to Q1 2012 at over 20mn barrels.

It appears small-scale theft and illegal refining are also becoming more decentralized and wide spread, though losses from such practices remain relatively small compared with the more sophisticated large-scale theft rings. In one striking example of rising costs, NNPC data shows the value of stolen crude along the 60km Forcados-Warri refinery supply pipeline was 600 percent higher in 2011 than in 2010. Total losses were N60 billion from this pipeline alone’ or N1bn of oil stolen per km of pipeline.

These incidences of crude theft also delay realization of revenues by deferring production. Shell has declared force majeure on onshore liftings five times since early 2011, all reportedly linked to illegal bunkering. One December 2011 stoppage, allegedly caused by two failed pipeline taps, took a month to fix and deferred over 4 million barrels. Damage to infrastructure also causes long-term production deferments. Government data shows dozens of fields sabotaged before the amnesty still sit idle. Shell’s onshore output’ currently around 600,000bpd’ is barely half of 2005 levels. In Delta State, Chevron still produces one third less oil than it did in 2008…”

No comments:

Post a Comment